ri tax rate on unemployment benefits

Mar 29 2021 0653 PM EDT. The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

Rhode Island Household Employment Tax And Labor Law Guide Care Com Homepay

The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate.

. North Dakota taxes unemployment compensation to the same extent that its taxed under federal law. Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment. Mortgage rates surpass 7 for first time since 2002 20 hours ago.

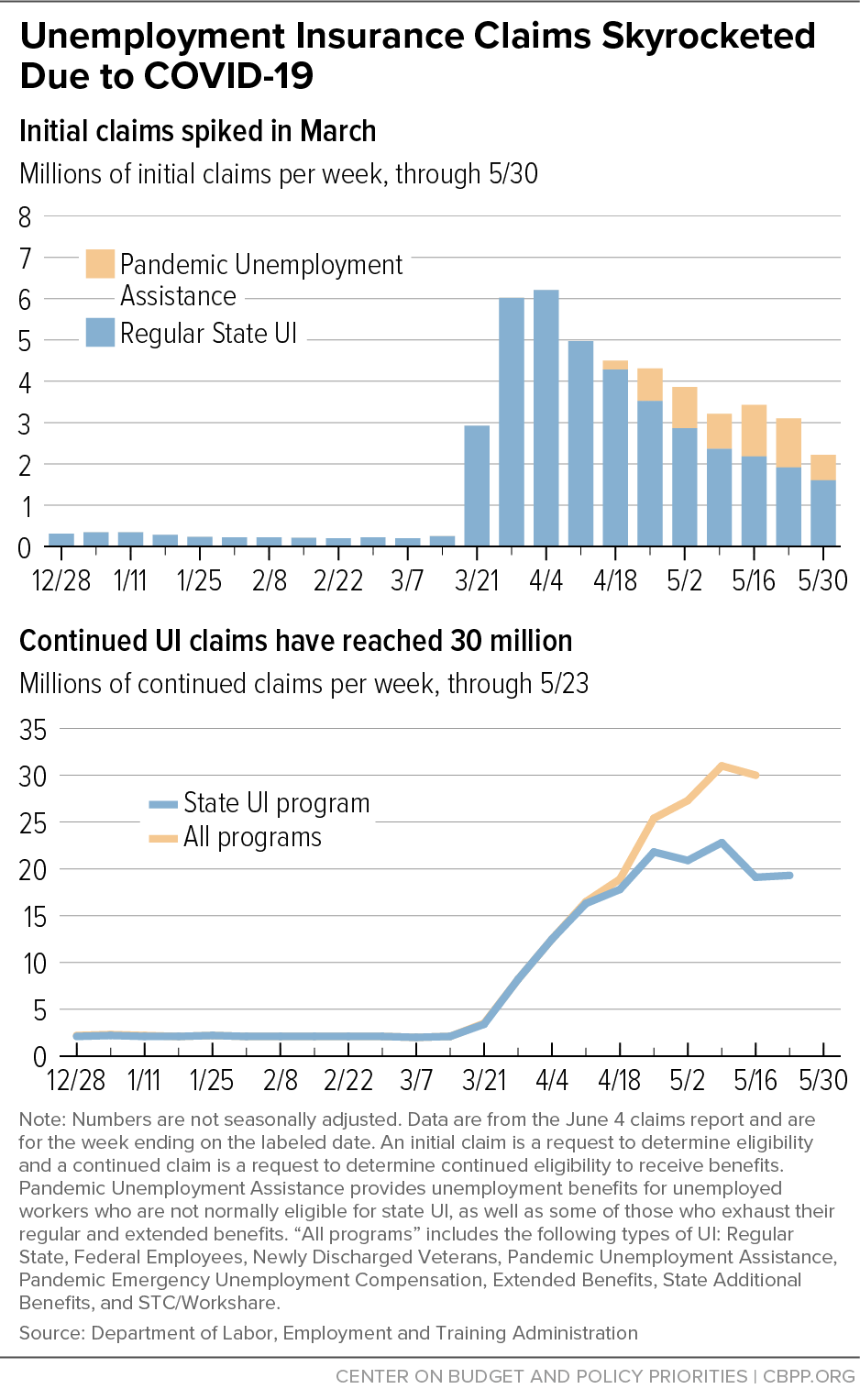

Unlike federal government RI will fully tax unemployment benefits Posted. The states unemployment rate in April of 2020 had spiked to 17 and RIPEC predicted the state would have to pay out 1026 million in monthly UI benefits throughout that. State Income Tax Range.

Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. By law the UI taxable wage base represents 465 of the. UI provides temporary income.

Normally unemployment benefits are subject to both federal and Rhode Island personal income tax. Your state will assign you a rate within this range. The rate for new employers which is based on the States five-year benefit cost rate for new employers will be 119 percent.

The Rhode Island Division of Taxation today provided guidance explaining that Rhode Islanders will be able to deduct up to 10200 of unemployment compensation on their federal personal income tax returns under a recent federal law change but must include that same amount as income on their Rhode Island state income tax. State Taxes on Unemployment Benefits. Most states send employers a new SUTA tax rate each year.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. These rates include the 021 percent Job Development Assessment. 11 on up to 40525 of.

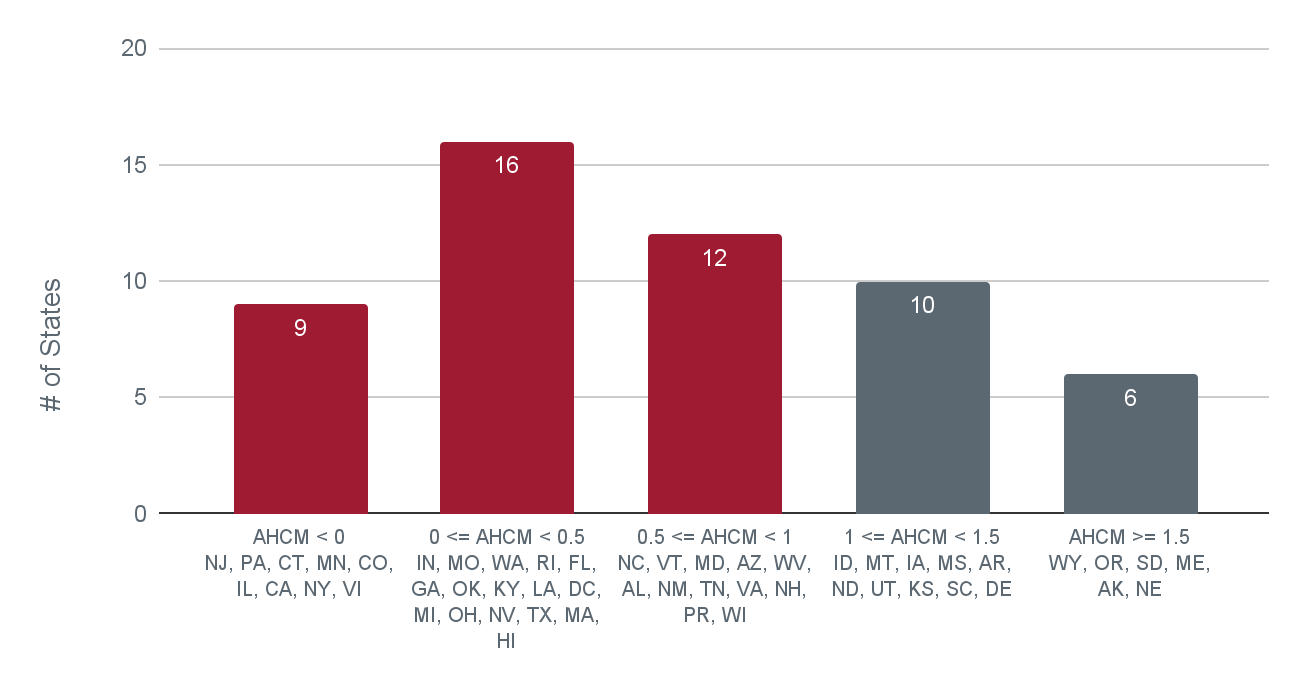

Generally states have a range of unemployment tax rates for established employers. As a result of this action Schedule H with rates ranging from 12 percent to 98 percent will remain in effect throughout calendar year 2022. CRANSTON Rhode Island businesses wont see an increase in their unemployment insurance tax rate for 2022 even though the trust fund that keeps benefits.

The rate for new employers which. For example the SUTA tax rates in Texas range from 031 631 in 2022.

R I Unemployment Rate Ticks Up To 2 8 In August

No Unemployment Insurance Tax Increases For 2022 Nfib

400m Tax Hike Follows Legislature S Failure To Resolve Ui Debt Cbia

Tax Season 2021 What To Know Before Filing In Rhode Island Newport Ri Patch

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Can I File A Ssdi Claim While On Unemployment

Delays For Unemployment Benefits Persist Over A Year Into Pandemic

Unemployment Insurance Cost Facts Every Rhode Island Nonprofit Should Know First Nonprofit Companies

Golocalprov New Ri Dlt Announces Unemployment Insurance Tax Rates For 2022

Golocalprov Scam Email Claiming To Be Ri Division Of Taxation Prompts Warning By State Officials

How To Claim Unemployment Benefits H R Block

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Rhode Island Ranks 40th In Tax Foundation 2022 Business Tax Climate Index Rhode Island Public Expenditure Council

Unemployment Insurance Tax Codes Tax Foundation

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

How Do State And Local Property Taxes Work Tax Policy Center

Unemployment Compensation Trust Funds Federal Aid To States

View All Hr Employment Solutions Blogs Workforce Wise Blog

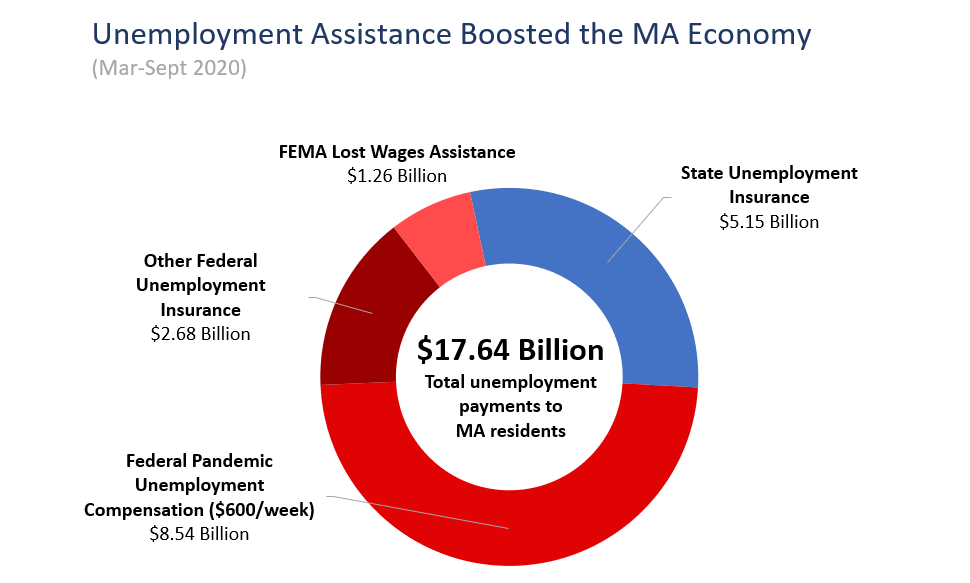

Unemployment Insurance Saved The Massachusetts Economy How Can We Ensure It Will Be Strong For The Future Mass Budget And Policy Center